We’ve all been to D-Mart at least once. And if you’ve watched the iconic web series Scam 1992: The Harshad Mehta Story, you might remember the calm, silent investor who stood beside the infamous “Black Cobra” — that man was none other than Radhakishan Damani.

In this article, we’ll explore Radhakishan Damani’s portfolio, his current holdings, and some interesting facts about his investments in 2025.

Radhakishan Damani is one of India’s most respected value investors and the founder of Avenue Supermarts, the company behind D-Mart. As of now, his net worth is over ₹1.85 lakh crore, making him one of the richest individuals in India.

Investment Philosophy

Damani is a strong believer in long-term value investing. While a massive chunk of his wealth comes from D-Mart shares, his other listed investments reflect smart picks with multibagger potential. If you’re curious to see what India’s “silent bull” is betting on — you’re in the right place.

Let’s dive into his latest stock holdings.

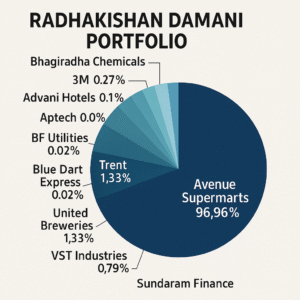

Radhakishan Damani Portfolio (Breakup)

As you can see, his portfolio is heavily dominated by Avenue Supermarts, which makes up ~97% of his total portfolio value.

However, if we exclude D-Mart, his portfolio is still worth a whopping ₹5,617 crore, with major holdings in:

-

Trent Ltd: ₹2,449.60 crore

-

VST Industries: ₹1,450.30 crore (Damani owns 29.1% stake)

-

3M India, United Breweries, and others

Below Table gives the complete detail of holdings

Complete Portfolio Holdings (2024)

| Company | Amount Invested in crores |

Percentage holding

|

| Bhagiradha Chemicals | 128.9 | 0.07% |

| 3M | 490 | 0.27% |

| Advani Hotels | 23.7 | 0.01% |

| Aptech | 28.8 | 0.02% |

| BF Utilities | 28.6 | 0.02% |

| Blue Dart Express | 195.3 | 0.11% |

| Trent | 2,449.60 | 1.33% |

| United Breweries | 661.9 | 0.36% |

| VST Industries | 1,450.30 | 0.79% |

| Mangalam Organics | 11.2 | 0.01% |

| Avenue Supermarts | 178,866.80 | 96.96% |

| Sundaram Finance | 149.2 | 0.08% |

| Total | 184484.3 | 100% |

Radhakishan Damani may not be as vocal or visible as some other investors, but his portfolio speaks volumes. His concentration in quality businesses, particularly in consumer and retail segments, reflects his deep conviction in India’s long-term consumption story.

If you’re someone who believes in tracking ace investors for inspiration, Damani’s strategy reminds us that patience, conviction, and business understanding matter more than noise.